November 11th

Slow sales and high inventory give buyers the edge in October |

Home sales registered on the MLS® in Metro Vancouver were 14 per cent lower than last October, as the trend of slower sales and building inventory creates favourable conditions for those looking to buy in the fall market.

The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 2,255 in October 2025, a 14.3 per cent decrease from the 2,632 sales recorded in October 2024. This was 14.5 per cent below the 10-year seasonal average (2,638).

“October is typically the last month of the year where sales activity sees a seasonal uptick, but sales still fell short of last year’s figures and the ten-year seasonal average,” said Andrew Lis, GVR’s chief economist and vice-president of data analytics. “Even the fourth cut this year to the Bank of Canada’s policy rate this October wasn’t enough to entice more buyers back into the market.”

There were 5,438 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in October 2025. This represents a 0.3 per cent decrease compared to the 5,452 properties listed in October 2024. This was 16.3 per cent above the 10-year seasonal average (4,676).

The total number of properties currently listed for sale on the MLS® system in Metro Vancouver is 16,393, a 13.2 per cent increase compared to October 2024 (14,477). This total is 35.9 per cent above the 10-year seasonal average (12,063).

Across all detached, attached and apartment property types, the sales-to-active listings ratio for October 2025 is 14.2 per cent. By property type, the ratio is 11.3 per cent for detached homes, 17.6 per cent for attached, and 15.5 per cent for apartments.

Analysis of the historical data suggests downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

“After peaking in June, inventory levels have edged lower, and prices have eased across all market segments as slower-than-usual sales activity meets the highest inventory levels seen in many years,” Lis said. “With no further reductions to the Bank of Canada’s policy rate expected in 2025, market conditions appear as favorable for buyers as they’ve been all year.”

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,132,500. This represents a 3.4 per cent decrease over October 2024 and a 0.8 per cent decrease compared to September 2025.

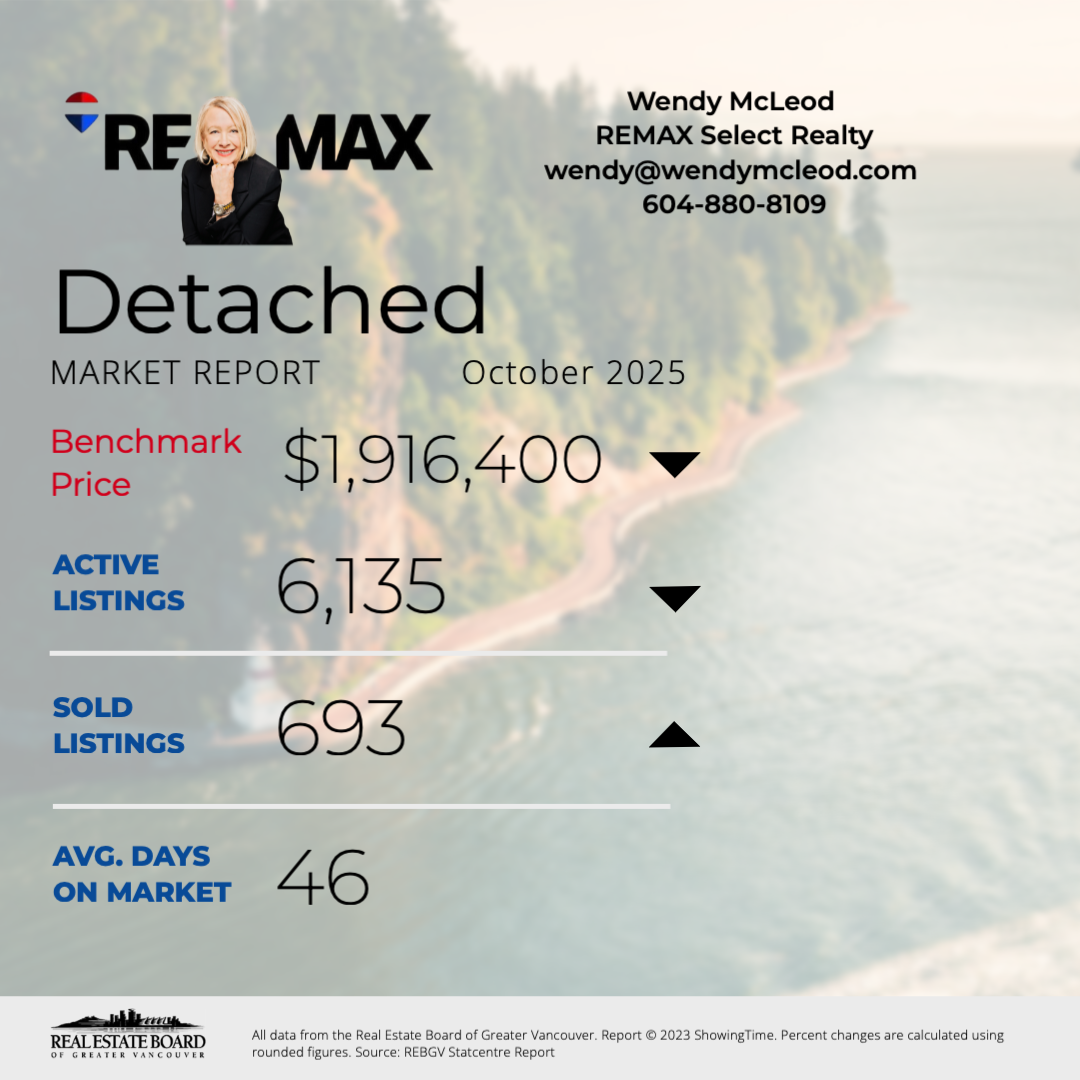

Sales of detached homes in October 2025 reached 693, a 4.3 per cent decrease from the 724 detached sales recorded in October 2024. The benchmark price for a detached home is $1,916,400. This represents a 4.3 per cent decrease from October 2024 and a 0.9 per cent decrease compared to September 2025.

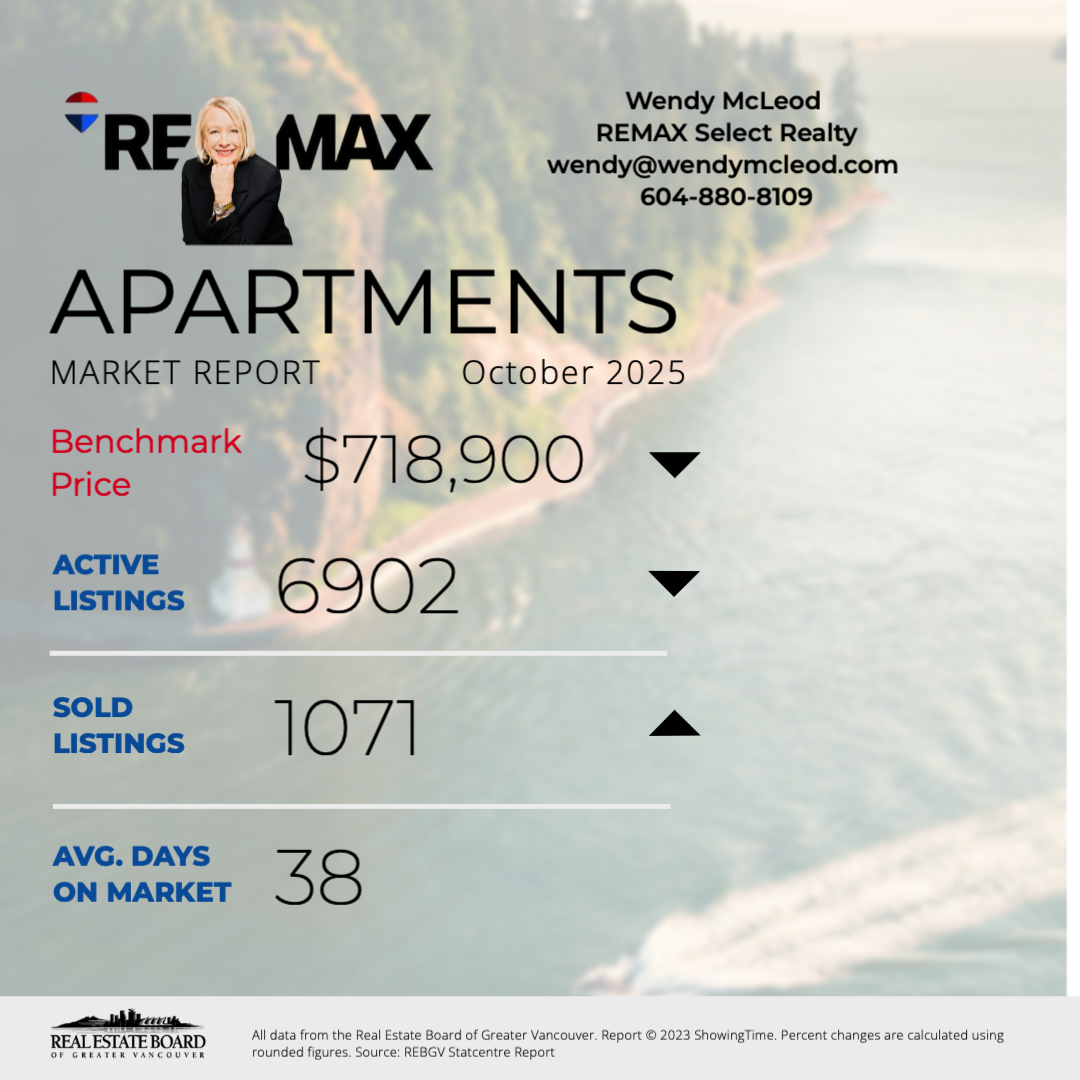

Sales of apartment homes reached 1,071 in October 2025, a 23.1 per cent decrease compared to the 1,393 sales in October 2024. The benchmark price of an apartment home is $718,900. This represents a 5.1 per cent decrease from October 2024 and a 1.4 per cent decrease compared to September 2025.

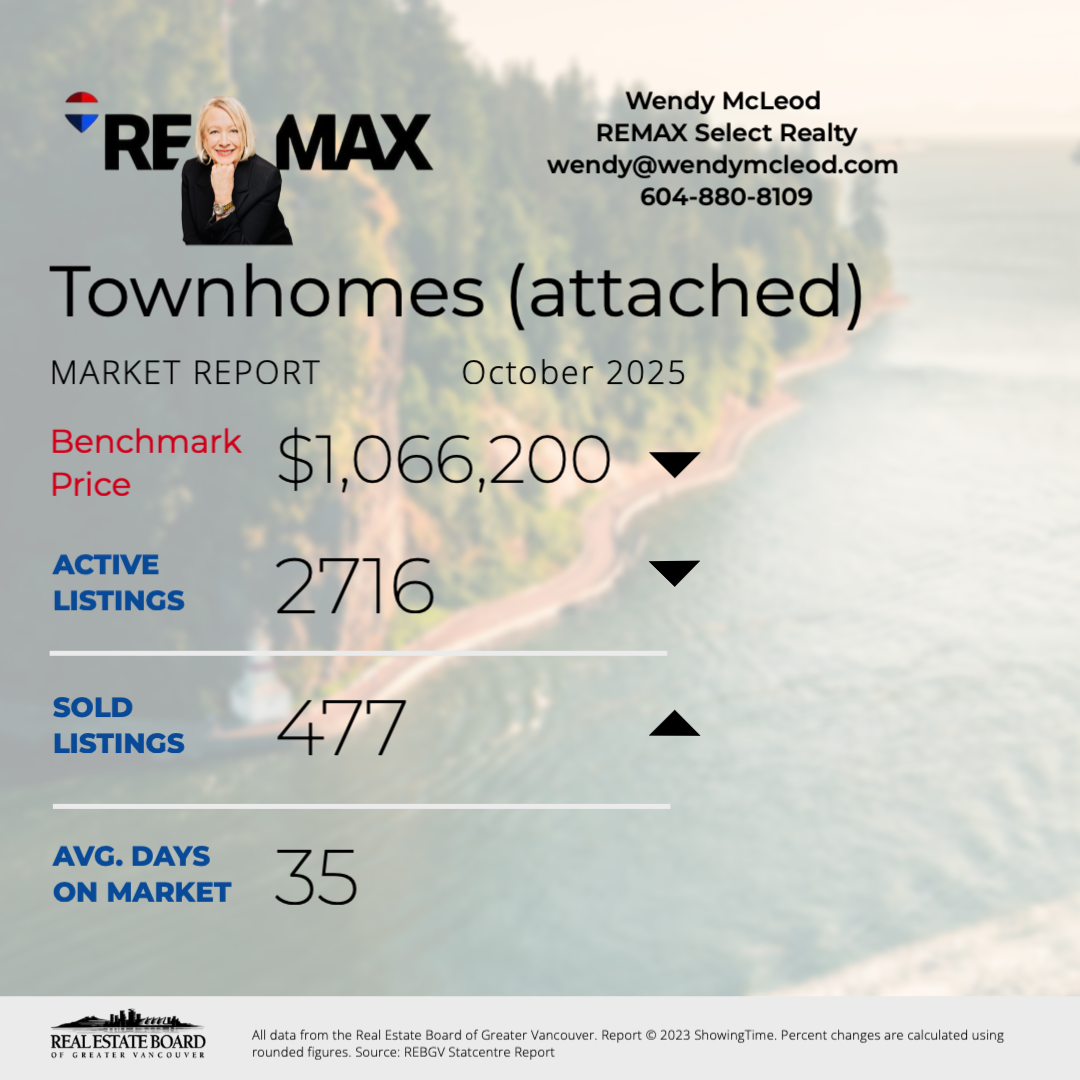

Attached home sales in October 2025 totalled 477, a 4.8 per cent decrease compared to the 501 sales in October 2024. The benchmark price of a townhouse is $1,066,700. This represents a 3.8 per cent decrease from October 2024 and a 0.3 per cent decrease compared to September 2025. |

| Download GVR's October 2025 MLS® Housing Market Report |

| ||

Dr. Sherry Cooper

Chief Economist, Dominion Lending Centres

drsherrycooper@dominionlending.ca

Another Bank of Canada rate cut and easing prices helped home sales registered on the MLS® in Metro Vancouver edge higher relative to September last year.

The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 1,875 in September 2025, a 1.2 per cent increase from the 1,852 sales recorded in September 2024. This was 20.1 per cent below the 10-year seasonal average (2,348).

“With another cut to Bank of Canada’s policy rate behind us, and markets pricing in at least one more cut by the end of the year, Metro Vancouver homebuyers have reason to be optimistic about the fall market,” said Andrew Lis, GVR’s director of economics and data analytics. “Easing prices, near-record high inventory levels, and increasingly favourable borrowing costs are offering those looking to purchase a home this fall with plenty of opportunity.”

There were 6,527 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in September 2025. This represents a 6.2 per cent increase compared to the 6,144 properties listed in September 2024. This was 20.1 per cent above the 10-year seasonal average (5,434).

The total number of properties currently listed for sale on the MLS® system in Metro Vancouver is 17,079, a 14.4 per cent increase compared to September 2024 (14,932). This is 36.1 per cent above the 10-year seasonal average (12,553).

Across all detached, attached and apartment property types, the sales-to-active listings ratio for September 2025 is 11.3 per cent. By property type, the ratio is 8.5 per cent for detached homes, 12.7 per cent for attached, and 13.3 per cent for apartments.

Analysis of the historical data suggests downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

“The past few years have been quite challenging for the market, beginning with 2022’s rapid increase in interest rates, major political and policy shifts in subsequent years, and recent trade tensions with the USA weighing on the market,” Lis said. “With the acute impacts of these events now fading, we expect market activity to continue stabilizing to end the year, barring any unforeseeable major disruptions.”

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,142,100. This represents a 3.2 per cent decrease over September 2024 and a 0.7 per cent decrease compared to August 2025.

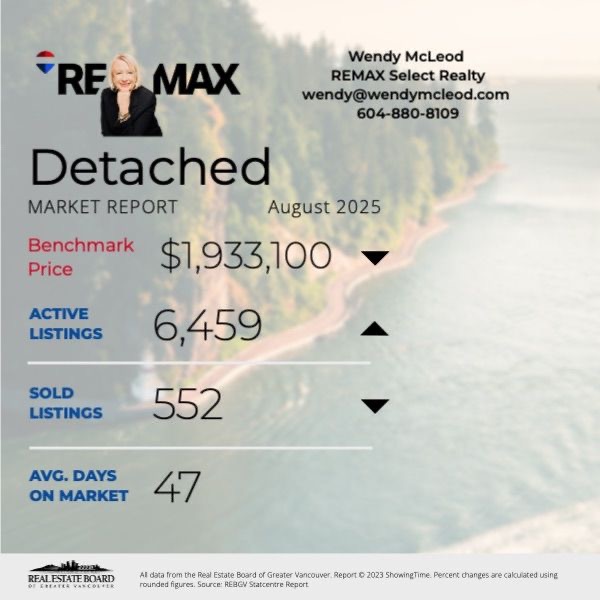

Sales of detached homes in September 2025 reached 552, a 7 per cent increase from the 516 detached sales recorded in September 2024. The benchmark price for a detached home is $1,933,100. This represents a 4.4 per cent decrease from September 2024 and a 0.9 per cent decrease compared to August 2025.

Sales of apartment homes reached 954 in September 2025, a 1.5 per cent increase compared to the 940 sales in September 2024. The benchmark price of an apartment home is $728,800. This represents a 4.4 per cent decrease from September 2024 and a 0.8 per cent decrease compared to August 2025.

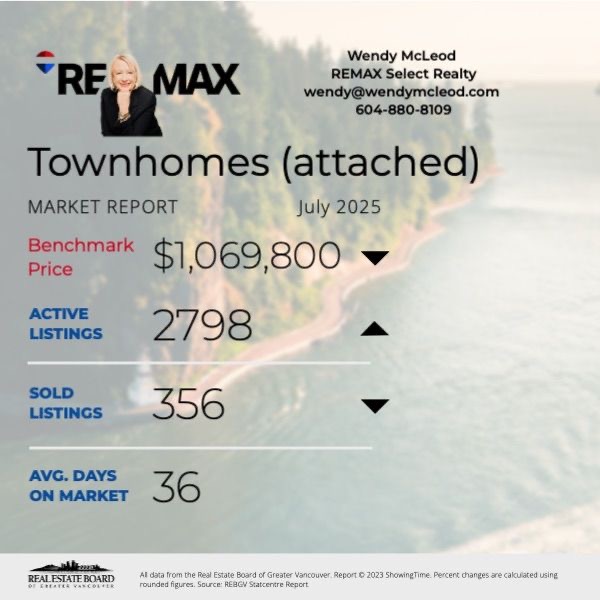

Attached home sales in September 2025 totalled 356, a 5.8 per cent decrease compared to the 378 sales in September 2024. The benchmark price of a townhouse is $1,069,800. This represents a 2.7 per cent decrease from September 2024 and a 0.9 per cent decrease compared to August 2025.

The Consumer Price Index (CPI) rose 2.4% on a year-over-year basis in September, up from a 1.9% increase in August. The acceleration in headline inflation from 1.9% in August was also larger than the median projection in a Bloomberg survey of economists, which was 2.2%.

On a year-over-year basis, gasoline prices fell less in September (-4.1%) compared with August (-12.7%) due to a base-year effect, leading to an acceleration in headline inflation. Excluding gasoline, the CPI rose 2.6% in September, after increasing 2.4% in August.

A slower year-over-year decline in prices for travel tours (-1.3%) and a larger increase in prices for food purchased from stores (+4.0%) also contributed to the upward pressure in the all-items CPI in September.

The CPI rose 0.1% month over month in September. On a seasonally adjusted monthly basis, the CPI was up 0.4%.

Gasoline prices fell 4.1% year over year in September after a 12.7% decrease in August. The smaller year-over-year decline was primarily due to a base-year effect. In September 2024, prices fell 7.1% month over month due, in part, to lower crude oil prices amid growing concerns of weaker economic growth, particularly in China and the United States. In September 2025, gasoline prices rose 1.9% monthly following refinery disruptions and maintenance in the United States and Canada, which put upward pressure on prices.

On a year-over-year basis, prices for travel tours fell 1.3% in September following a 9.3% decline in August. Despite typically declining on a month-over-month basis in September, travel tour prices rose 4.6% in the month. This was a result of higher prices for destinations in Europe and some parts of the United States, as significant events in destination cities put upward pressure on hotel prices.

Consumers paid 4.0% more year over year for food purchased from stores in September, following a 3.5% increase in August. Faster price growth was driven by increased prices for fresh vegetables (+1.9% in September, compared with -2.0% in August) and sugar and confectionery (+9.2% in September, compared with +5.8% in August).

Year-over-year grocery price inflation has generally trended upward since its most recent low in April 2024 (+1.4%). Grocery items contributing to the general acceleration included fresh or frozen beef and coffee, both due, in part, to lower supply.

Tuition fees, priced annually in September, increased 1.7% in 2025 compared with a 1.8% increase in 2024. Aside from 2019, the 2025 increase was the smallest since 1976, when the index was unchanged (0.0%).

In 2025, students from Prince Edward Island (+4.7%) experienced the largest price increase. At the same time, students from Nova Scotia (+1.1%) and Ontario (+1.1%) had the smallest increase, coinciding with a freeze on tuition fees in both provinces.

Bank of Canada Deputy Governor Rhys Mendes recently warned that traders may be putting too much emphasis on its two “preferred” core inflation measures, the so-called trim and median gauges.

In September, both CPI-median and CPI-trim came in hotter than economists were expecting. The average of these metrics was 3.15% in September, while the three-month moving average accelerated to 2.7%.

Mendes said the central bank is weighing a broader suite of gauges that suggest underlying price pressures are closer to its 2% target.

Shelter inflation rose 2.6% on an annual basis, while CPI excluding food and energy was 2.4%. CPI excluding eight volatile components and indirect taxes was 2.8%, up from 2.6%.

CPI excluding taxes accelerated to 2.9% from 2.4% the previous month.

The share of components within the consumer price index basket that are rising 3% and higher — another key metric that policymakers are watching closely — declined slightly to 38%.

All 10 Canadian provinces saw prices rising at a faster year-over-year pace in September compared with August. Quebec experienced the steepest price growth, reaching 3.3% last month.

Rent prices also accelerated nationally to 4.8%, led by a 9.8% increase in Quebec. Slower rent price growth of 1.8% in British Columbia moderated the national increase, the report noted.

Bottom Line

The report shows that underlying price pressures remain elevated, raising questions about how quickly the central bank can proceed with rate cuts to aid the tariff-hit economy.

Still, the acceleration in headline and most core measures was driven by a gasoline price base-year effect — a possible reason for analysts to look through the print.

Traders in overnight swaps pared bets on a rate cut next week, lowering the odds to about 65% from close to 80% before the report. The loonie jumped to the day’s high against the US dollar. Canadian debt fell across the curve, with the two-year yield rising about three basis points to a session high at 2.38%.

The ongoing trade war with the US drove the Bank of Canada to lower its policy rate by a quarter of a percentage point to 2.5% in September, marking the first cut in six months.

During their deliberations last month, some members of its governing council argued that more support would likely be needed given the softness in the economy, notably if the labour market weakened further.

Bank of Canada Governor Tiff Macklem recently described Canada’s labour market as “soft,” despite data showing the country added 60,400 jobs in September, which only partially reversed a decline of more than 100,000 positions over the previous two months.

The central bank will have to weigh recent economic weakness against concerns about firm core inflation over the past few months. The BoC will cut the overnight policy rate again by 25 bps to 2.25%, responding to its concern for the sectors hardest hit by tariffs, along with a housing market suffering from negative household psychology and overbuilding in the GTA and GVA.

Dr. Sherry Cooper

Chief Economist, Dominion Lending Centres

drsherrycooper@dominionlending.ca

Please visit our Open House at 402 PH2 2091 Vine Street in Vancouver. See details here

Open House on Saturday, October 18, 2025 1:00PM - 3:00PM

PENTHOUSE Living in the Heart of Kits! Experience boutique penthouse living on a beautiful tree-lined street, just steps to the best of Kitsilano—cafés, restaurants, shops, grocery stores, Kits Beach, and the upcoming Broadway Subway line. This bright and spacious 2-bed, 2-bath home offers large rooms, oversized closets, and airy layout streaming with natural light. Enjoy North Shore mountain views from your generous living area and cozy up by the gas fireplace on cool evenings. The bright kitchen and dining area have two private balconies, perfect for morning coffee or sunset views. Situated in a rainscreened 8-unit building, offering a true sense of community. Complete with 2 parking stalls and 1 storage locker. A perfect home for upsizers or downsizers alike—penthouse living at its best