September 2-25 Market Insights

The Bank of Canada has just lowered its policy rate by 25 basis points to 2.50% — the lowest in three years. This move is big news for our real estate market here in Vancouver. Let’s look at what’s driving the cut and, more importantly, what it means if you’re buying or selling.

Slowing economy: GDP slipped ~1.6% in Q2.

Job market softening: Rising unemployment is a concern.

Inflation cooling: Still a touch high at the core, but trending down.

Global uncertainties: Tariffs and trade pressures are weighing on growth.

Lower borrowing costs: Variable-rate mortgages and loans tied to prime should ease.

Fixed-rate relief: Fixed mortgages may dip as bond yields adjust.

More purchasing power: Lower payments could let you aim higher or simply buy with more comfort.

Increased competition: More buyers entering the market means hot listings could see multiple offers — being pre-approved is key.

Bigger buyer pool: Lower rates invite more demand.

Quicker sales: Homes may move faster, especially in desirable neighbourhoods.

Stronger pricing power: More buyers can mean stronger offers — though local inventory levels matter.

Great timing to move up: If you’re selling and buying again, lower rates make upgrading more attractive.

This is a modest cut — it helps, but affordability challenges remain.

Fixed rates don’t always move right away. Locking in now could be a smart hedge.

Rate cuts can reverse if inflation heats up or the economy worsens.

Every market is different — what we’re seeing in Vancouver might not mirror other regions.

This rate cut creates momentum. Whether you’re thinking of buying, selling, or simply watching the market, it’s a great time to explore your options.

If you’d like to know how this change impacts your specific situation, let’s connect — I’d be happy to walk you through the numbers.

Wendy McLeod, Vancouver Realtor — your trusted guide in every market.

FOR IMMEDIATE RELEASE

September 17, 2025

Today, the Bank of Canada lowered the overnight policy rate by 25 bps to 2.5% as was widely expected. Following yesterday's better-than-expected inflation report, the Bank believes that underlying inflation was 2.5% year-over-year.

Through the recent period of tariff turmoil, the Governing Council has closely monitored the risks and uncertainties facing the Canadian economy. Three developments triggered the Bank's rate cut. Canada's labour market softened further. Upward pressure on underlying inflation has diminished, and there is less upside to risk to future inflation with the removal of most retaliatory tariffs by Canada.

Considerable uncertainty remains. However, with a weaker economy and less upside risk to inflation, the Governing Council deemed that a reduction in the policy rate was appropriate to better balance the risks going forward.

"The Bank will continue to assess the risks, look over a shorter horizon than usual, and be ready to respond to new information."

Today's press release suggests that the global economy has slowed in response to trade disputes. In the US, business investment has been substantial, primarily driven by expenditures on Artificial Intelligence. However, consumers are cautious, and employment gains have slowed. It is nearly a certainty that the Federal Reserve will lower its overnight policy rate this afternoon.

"Growth in the euro area has moderated as US tariffs affect trade. China's economy held up in the first half of the year, but growth appears to be softening as investment weakens. Global oil prices are close to their levels assumed in the July Monetary Policy Report (MPR). Financial conditions have continued to ease, with higher equity prices and lower bond yields. Canada's exchange rate has been stable relative to the US dollar."

Canada's economy contracted in the second quarter, posting a growth rate of -1.6%. Exports fell by 27% in Q2 following a surge in exports in advance of tariffs in Q1. Business investment also fell in Q2. "In the months ahead, slow population growth and the weakness in the labour market will likely weigh on household spending."

Employment has declined in the past two months. "Job losses have largely been concentrated in trade-sensitive sectors, while employment growth in the rest of the economy has slowed, reflecting weak hiring intentions. The unemployment rate has moved up since March, hitting 7.1% in August, and wage growth has continued to ease."

Bottom Line

The Bank of Canada was pretty tight-lipped about future rate cuts, but given the current trajectory, we expect another rate cut when they meet again this fall. The next BoC decision date is October 29, and the central bank wraps up the year on December 10. We expect at least one more rate cut this year, ending the year with a policy rate of 2.0%-2.25%. This should help boost interest-sensitive spending, most particularly housing, where there is considerable pent-up demand.

The Bank will move cautiously, but with the Fed cutting rates again later this year, this gives the BoC cover. While some have questioned the Bank's easing in the face of 3% core inflation, other inflation measures suggest that underlying inflation is roughly 2.5%. The economic and labour market slowdown bodes well for another rate cut.

Traders in overnight swaps continue to price in another cut from the central bank this cycle, and put the odds at about a coin flip that they'll ease again in October.

The central bank's communications suggest that while it has resumed monetary easing to support the ailing economy, it is leery of cutting interest rates too quickly, given the potential inflation risks posed by the surge in global protectionism and tariffs.

Economists say they found some encouraging signs in the latest inflation numbers but some warn the Bank of Canada might need a bit more convincing to cut its key interest rate next month.

The annual rate of inflation fell to 1.7 per cent in July, Statistics Canada said Tuesday, down from 1.9 per cent in June. The reading was a tenth of a percentage point below most economists’ expectations.

A 16.1 per cent decline year-over-year in gas prices tied mainly to the removal of the consumer carbon price earlier this year fuelled the drop.

BMO chief economist Doug Porter said in an interview that the July consumer price index was a “relatively favourable report” despite some stubbornness at the grocery store and in housing.

July’s consumer price index marks the first of two looks at inflation that the Bank of Canada will get before its next interest rate decision on Sept. 17. The central bank held its policy rate steady at 2.75 per cent in July.

The Bank of Canada has been looking for signs of how Canada’s tariff dispute is affecting inflation, and is particularly concerned with trends in core inflation that strip out influences from tax changes and other volatile inputs.

Statistics Canada said the Bank of Canada’s preferred measures of core inflation held around three per cent in July.

Porter pointed out that another measure of core inflation that strips out influences from food and energy was lower in July, around 2.6 per cent.

Looking at those readings, he said the July CPI report “slightly turned the dial” toward a rate cut in September, aligning with BMO’s expectations.

Financial market odds for a quarter-point rate cut in September increased modestly to around 40 per cent as of Tuesday afternoon, according to LSEG Data & Analytics.

But with core inflation still elevated compared with the headline figure, Porter acknowledged BMO’s call for a cut next month was “a long shot” at this point.

“We need some help in the inflation numbers. We probably need a relatively sluggish jobs number as well,” he said.

CIBC senior economist Andrew Grantham said in a note that the lack of easing in core inflation can mostly be attributed to the base-year effect -- the distortion from price movements last year on a particular month’s annual inflation comparisons.

He said the shorter-term, three-month core inflation readings now show an annualized rate of 2.4 per cent for July.

Grantham said there’s still more data to come before the Bank of Canada’s next rate decision, but the July inflation figures support his call for a quarter-point cut in September.

RBC, meanwhile, is maintaining its call for no more interest rate cuts from the Bank of Canada this year.

Claire Fan, senior economist with RBC, said in a note that the monthly advance in core inflation was less than she was expecting. But she said pressure is still spread broadly through the consumer price index.

Inflation on food from the grocery store accelerated to 3.4 per cent annually in July, up from 2.8 per cent in June.

Confectionary prices rose 11.8 per cent and coffee gained 28.6 per cent to be among the biggest contributors to food inflation last month.

Statistics Canada said poor growing conditions in countries that produce cocoa and coffee beans were to blame for higher costs.

Prices for fresh grapes were up nearly 30 per cent, driving the overall cost for fresh fruit up 3.9 per cent in July compared with 2.1 per cent in June.

Porter said there are some hints that Canada’s tariff dispute with the United States is a factor keeping food inflation elevated, but he stopped short of blaming it for pain at the grocery store.

“I think the bigger story is coffee prices ... chocolate prices and beef prices, and those aren’t really a tariff story. Those are more climate issues,” he said.

Tariffs from the U.S. are driving a bit of “stickiness” in durable goods inflation, Porter noted, particularly in motor vehicles.

In addition to duties placed on some Canadian inputs, U.S. tariffs on vehicles from around the world are driving some “spillover” effects on inflation in Canada, he said.

“The trade war has had an effect on auto prices and autos are a big share of the CPI,” he said.

“So yes, unfortunately we have not totally escaped the trade war in our inflation data.”

Shelter inflation also saw a modest acceleration to three per cent last month from 2.9 per cent in June, marking the first increase in the category since February 2024.

Rent price growth picked up in July, particularly in Prince Edward Island, Newfoundland and Labrador and British Columbia. Lower mortgage costs are still moderating the overall increase in shelter inflation.

Prices for natural gas fell to a lesser degree than in June, thanks mostly to higher costs in Ontario.

Porter said the stubbornness in shelter inflation has been “frustrating,” but market data continues to show rent dropping in major cities across Canada, so he expects further easing in this CPI component through the rest of the year.

This report by The Canadian Press was first published Aug. 19, 2025.

By Craig Lord

Today's release of the July housing data by the Canadian Real Estate Association (CREA) showed good news on the housing front. Following a disappointing spring selling season, National home sales were up 3.8% in July from the month before, with Toronto seeing transactions rebound 35.5% since March. However, the total number of Toronto sales remains low by historical standards.

On a year-over-year basis, total transactions have risen 11.2% since March.

There is growing confidence that the Canadian economy will resiliently weather the tariff trauma. The Canadian dollar is up, and longer-term interest rates have edged downward in the past ten days. Traders are now anticipating a rate cut by the Federal Reserve in September.

Tuesday's release of the Canadian CPI will provide another data point for the Bank of Canada. Economic growth has held up, in large part because much of the pain from tariffs has been confined to industries singled out for levies, including autos, steel and aluminum.

Shaun Cathcart, the real estate board's senior economist, said, “With sales posting a fourth consecutive increase in July, and almost 4% at that, the long-anticipated post-inflation crisis pickup in housing seems to have finally arrived. The shock and maybe the dread that we felt back in February, March and April seem to have faded," as people become less concerned about their future employment.

New Listings

New supply was little changed (+0.1%) month-over-month in July. Combined with the notable increase in sales, the national sales-to-new listings ratio rose to 52%, up from 50.1% in June and 47.4% in May. The long-term average for the national sales-to-new listings ratio is 54.9%, with readings roughly between 45% and 65% generally consistent with balanced housing market conditions.

There were 202,500 properties listed for sale on all Canadian MLS® Systems at the end of July 2025, up 10.1% from a year earlier and in line with the long-term average for that time of the year.

“Activity continues to pick up through the transition from the spring to the summer market, which is the opposite of a normal year, but this has not been a normal year,” said Valérie Paquin, CREA Chair. “Typically, we see a burst of new listings right at the beginning of September to kick off the fall market, but it seems like buyers are increasingly returning to the market.

There were 4.4 months of inventory on a national basis at the end of July 2025, dropping further below the long-term average of five months of inventory as sales continue to pick up. Based on one standard deviation above and below that long-term average, a seller’s market would be below 3.6 months, and a buyer’s market would be above 6.4 months.

Home Prices

The National Composite MLS® Home Price Index (HPI) was unchanged between June and July 2025. Following declines in the first quarter of the year, the national benchmark price has remained mostly stable since May.

The non-seasonally adjusted National Composite MLS® HPI was down 3.4% compared to July 2024. This was a smaller decrease than the one recorded in June.

Based on the extent to which prices fell off in the second half of 2024, look for year-over-year declines to continue to shrink in the months ahead.

Bottom Line

Homebuyers are responding to improving fundamentals in the Canadian housing market. Supply has risen as new listings surged until May of this year. Additionally, the benchmark price was $688,700, 3.4% lower than a year earlier. That decrease was smaller than in June, and the board expects year-over-year declines to continue shrinking, it said in a statement.

While many expect the Fed to ease in September, I'm not sure it will happen. The producer price index came in hotter than expected this week. Fed action will depend mainly on the personal consumption expenditures index (PCE), the Fed's favourite measure of inflation, which will be out on August 29.

US stagflation worries have emerged with the release of the July employment report, which showed considerable weakness, enough to get the head of the Bureau of Labour Statistics fired. The likelihood of a BoC cut will increase if the Fed begins a series of easing moves as the administration is demanding.

Dr. Sherry Cooper

Chief Economist, Dominion Lending Centres

drsherrycooper@dominionlending.ca

METRO VANCOUVER MARKET HIGHLIGHTS

JULY 2025

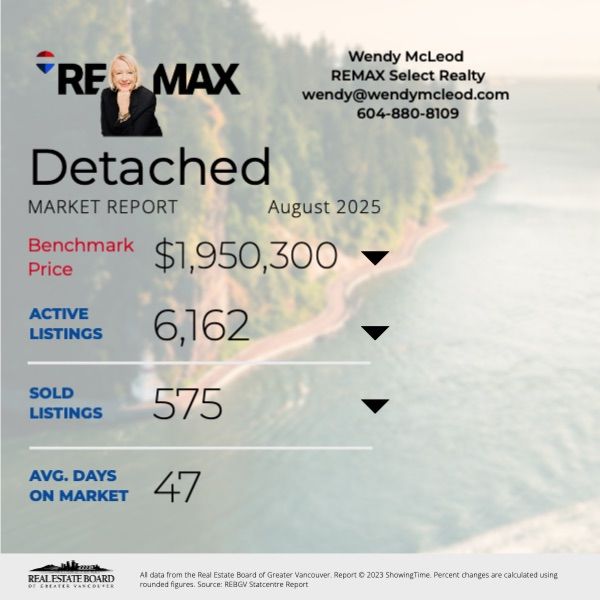

DETACHED

Active Listings:6,483

Sales 660

Benchmark Price:$1,974,400

Avg. Days On Market:42

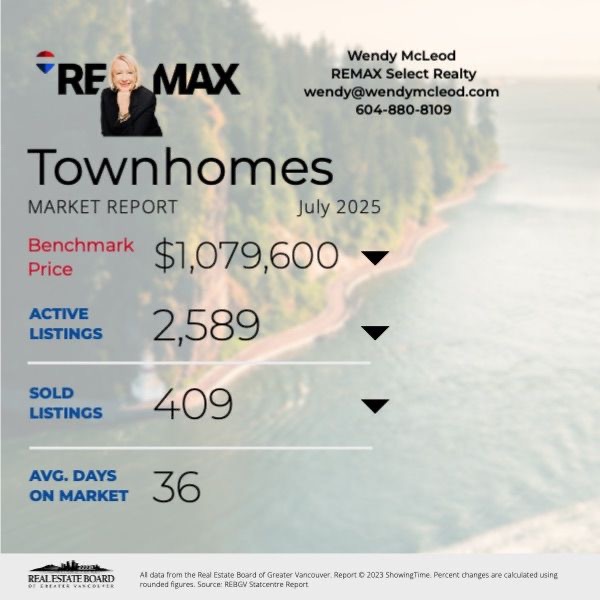

TOWNHOUSE

Active Listings:2,755

Sales 459

Benchmark Price:$1,099,200

Avg. Days On Market:30

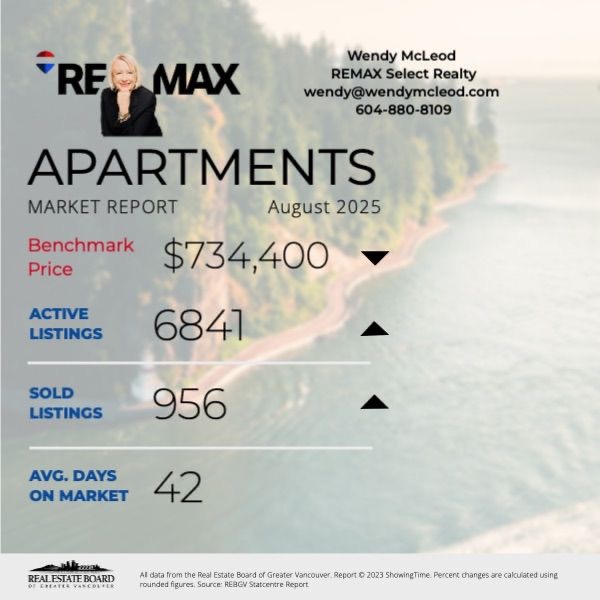

APARTMENT

Active Listings:7,263

Sales 1,158

Benchmark Price:$743,700

Avg. Days On Market:35

July 2024

2,333

Sold

July 2025

2,286

Sold

(-2%)

Residential property sales in Metro Vancouver

Home sales registered on the MLS® across Metro Vancouver* in July extended the early signs of recovery that emerged in June, now down just two per cent from July of last year.

The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 2,286 in July 2025, a two per cent decrease from the 2,333 sales recorded in July 2024. This was 13.9 per cent below the 10-year seasonal average (2,656).

"The June data showed early signs of sales activity in the region turning a corner, and these latest figures for July are confirming this emerging trend. Although the Bank of Canada held the policy rate steady in July, this decision could help bolster sales activity by providing more certainty surrounding borrowing costs at a time where economic uncertainty lingers due to ongoing trade negotiations with the US."Andrew Lis, GVR director of economics and data analytics

There were 5,642 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in July 2025. This represents a 0.8 per cent increase compared to the 5,597 properties listed in July 2024. This was 12.4 per cent above the 10-year seasonal average (5,018).

The total number of properties currently listed for sale on the MLS® system in Metro Vancouver is 17,168, a 19.8 per cent increase compared to July 2024 (14,326). This is 40.2 per cent above the 10-year seasonal average (12,249).

Across all detached, attached and apartment property types, the sales-to-active listings ratio for July 2025 is 13.8 per cent. By property type, the ratio is 10.2 per cent for detached homes, 16.7 per cent for attached, and 15.9 per cent for apartments.

Sales-to-Active Listings Ratio - July 2025

Detached

10.2%

Attached

16.7%

Apartment

15.9%

Total 13.8%

"With the rate of homes coming to market holding steady in July, the inventory of homes available for sale on the MLS® has stabilized at around 17,000. This level of inventory provides buyers plenty of selection to choose from,” Lis said.

“Although sales activity is now recovering, this healthy level of inventory is sufficient to keep home prices trending sideways over the short term as supply and demand remain relatively balanced. However, if the recovery in sales activity accelerates, these favorable conditions for home buyers may begin slowly slipping away, as inventory levels decline, and home sellers gain more bargaining power.”

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,165,300. This represents a 2.7 per cent decrease over July 2024 and a 0.7 per cent decrease compared to June 2025.

Sales of detached homes in July 2025 reached 660, a 4.1 per cent decrease from the 688 detached sales recorded in July 2024. The benchmark price for a detached home is $1,974,400. This represents a 3.6 per cent decrease from July 2024 and a 1 per cent decrease compared to June 2025.

Sales of apartment homes reached 1,158 in July 2025, a 2.9 per cent decrease compared to the 1,192 sales in July 2024. The benchmark price of an apartment home is $743,700. This represents a 3.2 per cent decrease from July 2024 and a 0.6 per cent decrease compared to June 2025.

Attached home sales in July 2025 totalled 459, a five per cent increase compared to the 437 sales in July 2024. The benchmark price of a townhouse is $1,099,200. This represents a 2.3 per cent decrease from July 2024 and a 0.4 per cent decrease compared to June 2025.

* Areas covered by Greater Vancouver REALTORS® include: Bowen Island, Burnaby, Coquitlam, Maple Ridge, New Westminster, North Vancouver, Pitt Meadows, Port Coquitlam, Port Moody, Richmond, South Delta, Squamish, Sunshine Coast, Vancouver, West Vancouver, and Whistler.

Greater Vancouver REALTORS® is an association representing more than 15,000 REALTORS® and their companies. The association provides a variety of member services, including the Multiple Listing Service®. For more information on real estate, statistics, and buying or selling a home, contact a local REALTOR® or visit www.gvrealtors.ca.

Buying your first home is a big step—and doing it in a competitive market like Vancouver adds extra layers of excitement and complexity. Whether you're drawn by the ocean views, lush parks like Stanley Park, or the vibrant neighborhood life, it's important to be prepared. With BC Day just around the corner—a holiday that celebrates all things British Columbia—there’s no better time to start planning your homeownership journey.

Here are 5 essential tips for buying a home in Vancouver, especially tailored for first-time homebuyers.

Vancouver is one of Canada’s most dynamic and fast-paced real estate markets. Over the last decade, prices have consistently trended upward, making early planning crucial. According to the latest data, the benchmark price for a detached home in Greater Vancouver is over $1.9 million, while condos and townhomes remain more affordable options for first-time buyers.

In neighborhoods like Mount Pleasant, Commercial Drive, and Kitsilano, you’ll find a mix of newer builds and heritage charm. If you're budget-conscious but still want proximity to downtown, look into East Vancouver communities such as Renfrew or Hastings-Sunrise. Staying informed on local housing trends, including seasonal fluctuations, can help you spot opportunities.

Pro Tip: Real estate activity tends to heat up after BC Day in early August, so planning now puts you ahead of the post-summer wave of competition.

Before attending open houses or scrolling through MLS listings, it’s critical to get mortgage pre-approval. This gives you a clear picture of your budget and shows sellers you’re serious.

Banks, credit unions, and mortgage brokers can help you navigate your options. Many first-time buyers in Vancouver also explore programs like:

The First-Time Home Buyer Incentive

The Home Buyers’ Plan (HBP)

BC First-Time New Home Buyers’ Program

These programs can reduce your costs and make it easier to break into the Vancouver market.

Vancouver is more than just a city—it’s a collection of unique neighborhoods, each with its own vibe and amenities. Whether you crave beachside living near Kits Beach, love urban parks like Stanley Park, or prefer the quieter family feel of Dunbar or Fraserview, there's something for everyone.

When house hunting, consider:

Proximity to public transit (like SkyTrain lines)

Access to grocery stores, cafes, and healthcare

Nearby schools and daycare options

Community events and green space

On a sunny long weekend like BC Day, take time to walk the streets of neighborhoods you're considering. Grab a coffee, visit local markets, or bike the Seawall to really get a feel for the lifestyle.

In a competitive and sometimes unpredictable market like Vancouver, working with an experienced, hyperlocal real estate agent is your best advantage. A knowledgeable agent can:

Identify off-market opportunities

Provide accurate comparative market analysis

Help negotiate in bidding wars

Connect you with reliable inspectors, lawyers, and mortgage pros

Look for a realtor who knows the area and understands the nuances of the Vancouver market—from laneway homes to strata bylaws. A trusted advisor can simplify the process and help you avoid common first-time buyer mistakes.

Buying a home in Vancouver isn’t just about today—it’s about your future. Whether you’re hoping to start a family, build equity, or eventually upgrade, think long term. Look at:

Potential for property value appreciation

Future zoning changes or new developments nearby

Lifestyle needs (e.g., parking, pet-friendly strata, outdoor space)

Also, understand your total cost of ownership. Besides your mortgage, factor in:

Property taxes

Strata fees (for condos and townhomes)

Home insurance

Ongoing maintenance and repairs

This kind of planning ensures you’re not just buying a home—you’re building a stable foundation for years to come.

With interest rates stabilizing and new inventory entering the market, many experts believe fall 2025 could offer a more balanced opportunity for first-time homebuyers in Vancouver. By starting your research now—just after BC Day—you’re giving yourself time to prepare and act strategically before the year ends.

Buying your first home in Vancouver is a big leap, but with the right knowledge and guidance, it can be one of the most rewarding decisions you'll ever make. From walkable neighborhoods near Stanley Park to the growing communities in East Vancouver, there’s a perfect place out there for you.

Whether you're dreaming of high-rise condo views or a cozy townhouse with mountain access, these tips will put you on the right path.

Thinking of buying your first home in Vancouver? Let’s talk—I’m here to guide you every step of the way.