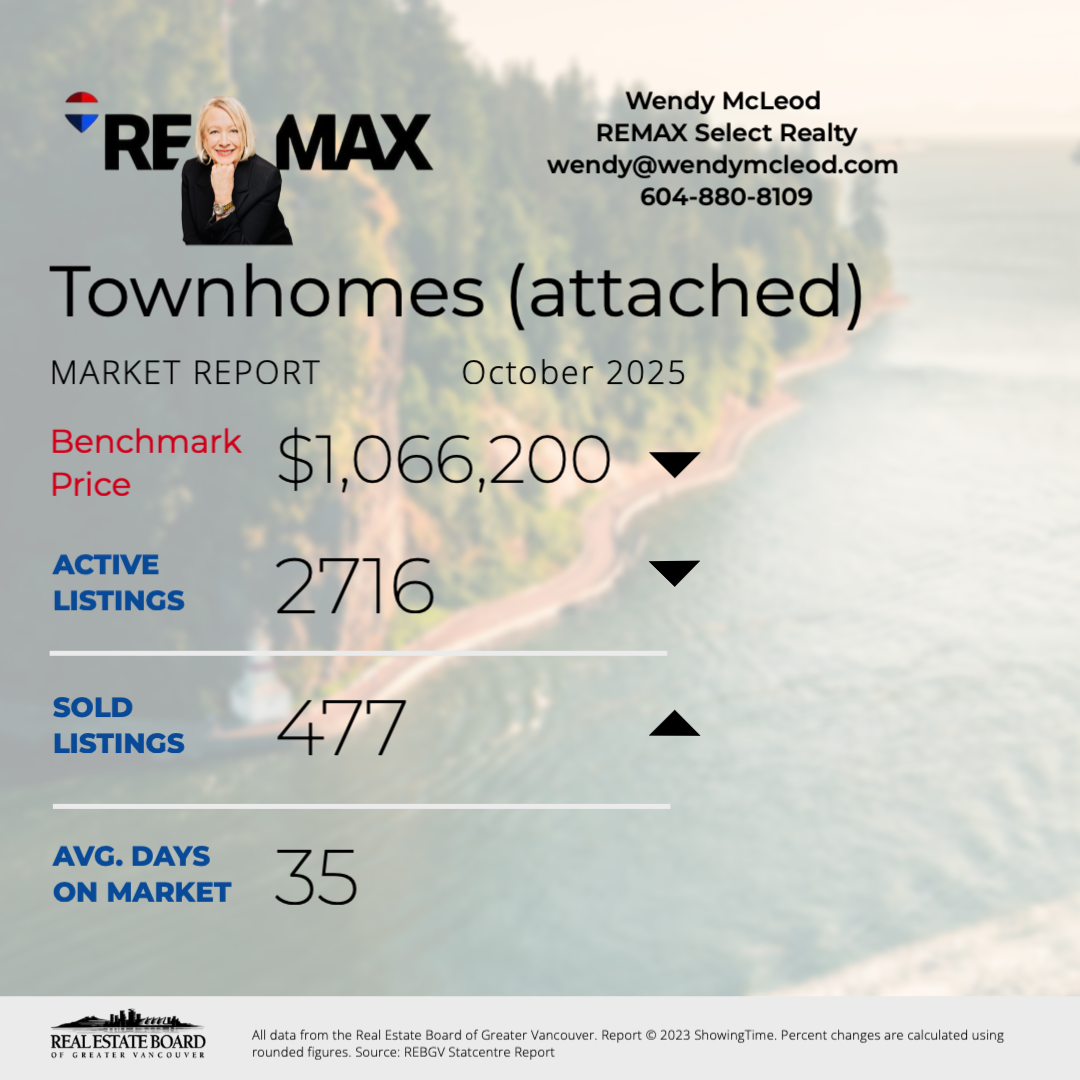

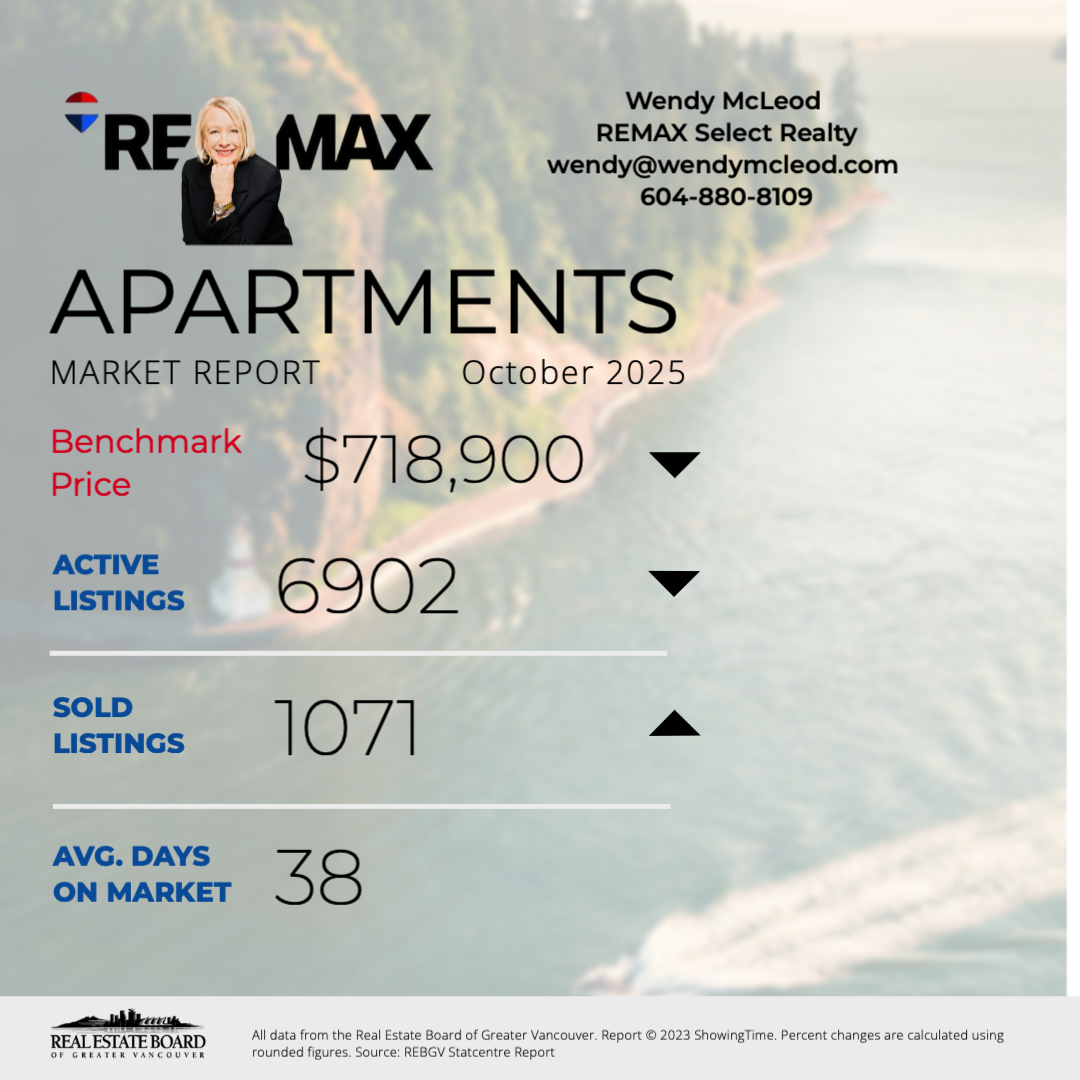

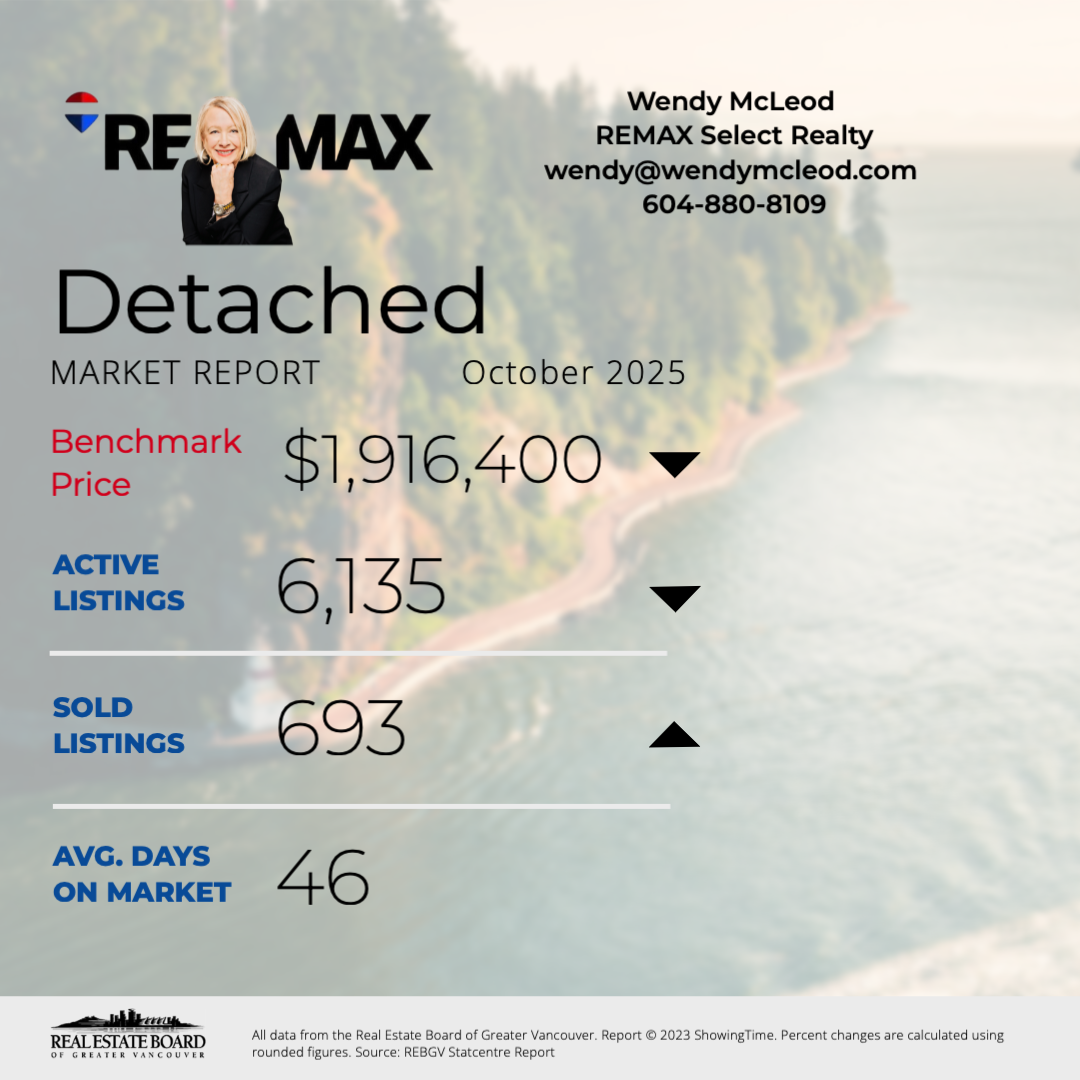

Home sales registered on the MLS® in Metro Vancouver were 14 per cent lower than last October, as the trend of slower sales and building inventory creates favourable conditions for those looking to buy in the fall market. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 2,255 in October 2025, a 14.3 per cent decrease from the 2,632 sales recorded in October 2024. This was 14.5 per cent below the 10-year seasonal average (2,638). “October is typically the last month of the year where sales activity sees a seasonal uptick, but sales still fell short of last year’s figures and the ten-year seasonal average,” said Andrew Lis, GVR’s chief economist and vice-president of data analytics. “Even the fourth cut this year to the Bank of Canada’s policy rate this October wasn’t enough to entice more buyers back into the market.” There were 5,438 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in October 2025. This represents a 0.3 per cent decrease compared to the 5,452 properties listed in October 2024. This was 16.3 per cent above the 10-year seasonal average (4,676). The total number of properties currently listed for sale on the MLS® system in Metro Vancouver is 16,393, a 13.2 per cent increase compared to October 2024 (14,477). This total is 35.9 per cent above the 10-year seasonal average (12,063). Across all detached, attached and apartment property types, the sales-to-active listings ratio for October 2025 is 14.2 per cent. By property type, the ratio is 11.3 per cent for detached homes, 17.6 per cent for attached, and 15.5 per cent for apartments. Analysis of the historical data suggests downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months. “After peaking in June, inventory levels have edged lower, and prices have eased across all market segments as slower-than-usual sales activity meets the highest inventory levels seen in many years,” Lis said. “With no further reductions to the Bank of Canada’s policy rate expected in 2025, market conditions appear as favorable for buyers as they’ve been all year.” The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,132,500. This represents a 3.4 per cent decrease over October 2024 and a 0.8 per cent decrease compared to September 2025. Sales of detached homes in October 2025 reached 693, a 4.3 per cent decrease from the 724 detached sales recorded in October 2024. The benchmark price for a detached home is $1,916,400. This represents a 4.3 per cent decrease from October 2024 and a 0.9 per cent decrease compared to September 2025. Sales of apartment homes reached 1,071 in October 2025, a 23.1 per cent decrease compared to the 1,393 sales in October 2024. The benchmark price of an apartment home is $718,900. This represents a 5.1 per cent decrease from October 2024 and a 1.4 per cent decrease compared to September 2025. Attached home sales in October 2025 totalled 477, a 4.8 per cent decrease compared to the 501 sales in October 2024. The benchmark price of a townhouse is $1,066,700. This represents a 3.8 per cent decrease from October 2024 and a 0.3 per cent decrease compared to September 2025. |